Family Bank encourages customers to monitor transactions, verify recipients, and stay alert to prevent fraud this festive season.

It is going to get busy during this festive period, with a lot of higher spending, travelling, and shopping. A lot of mobile and online banking is going to happen with cards being used more often, and mobile money being sent to family and friends. While this digital banking brings a lot of convenience during this holiday season, it will also be imperative for customers to be even more cautious and alert.

While there are increased fraud attempts during this season, it doesn’t mean that you should now start avoiding digital banking. What you need to understand is how to use everyday banking tools very carefully.

Customers are going to rely heavily on debit cards for shopping, everyday expenses and dining during this festive period. Online shopping will also increase, especially on unfamiliar websites or platforms, if you’re looking for the best deals. This means that you will have to closely monitor your card’s transactions during this season. With transaction alerts, you can flag unfamiliar or suspicious activity very early, which gives you time to report issues before they escalate.

You will also need to regularly check statements to make it easier to spot small transactions that don’t look right. It is important that when you’re online shopping during this period, you only stick to trusted websites and avoid links which you will get through unsolicited messages or emails, and always confirm payments before completing them.

Read also – Family Bank Urges And Guides Customers To Stay Scam Safe

The convenience that comes with mobile banking apps and internet banking comes in handy for the customers who will travel to multiple locations during this festive period. You will need to be very careful since you’re outside the normal environment.

This calls for you to avoid using public WiFi networks when accessing mobile or internet banking and make sure that you are logged out after every session, especially if you are using a borrowed or shared device. Your phone should remain locked, apps updated to the latest version and use private and very strong passwords to reduce the risk of unauthorised access.

One thing to keep in mind is that you’ll need to plan ahead when travelling by knowing how to reach your bank in case support is needed.

Family Bank’s Family Pay and account transfer services make sending money to family and friends or merchants during this festive season fast and convenient.

However, you will need to first confirm recipient details very carefully and take a moment to review the transaction before sending money. As mentioned in our earlier article, fraudsters will take advantage during this holiday period to send messages or emails that create urgency or ask for unexpected payments. You are also advised as a customer to avoid responding to unsolicited payment requests and to also verify any unusual instructions directly with the intended recipient for confirmation.

This means you will have to slow down for a few seconds before confirming a transfer so that you prevent very costly mistakes.

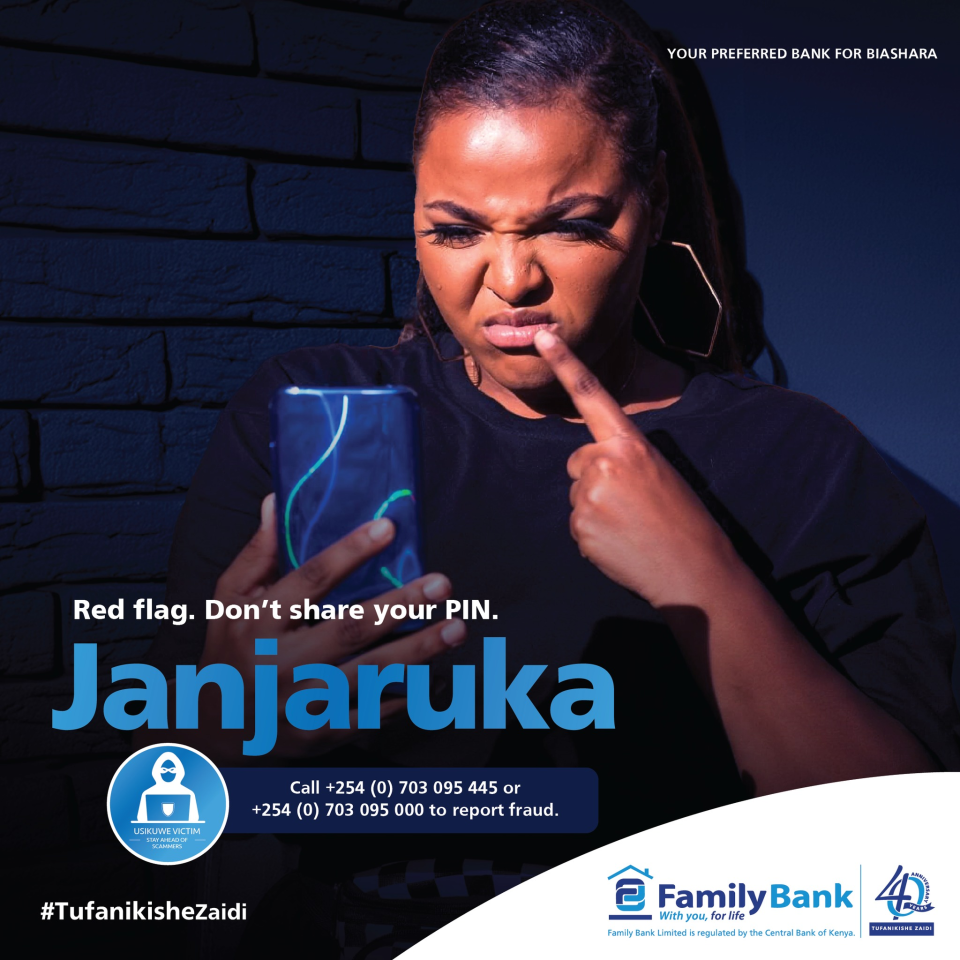

You should always be on the lookout for suspicious activity, be it unrecognised transactions, unexpected prompts to share confidential details or unusual messages or emails asking for the same information, as these are clear signs of attempted fraud.

You should know that Family Bank services are never used to demand confidential information, and they will never rush customers to make quick decisions or even threaten you with penalties through informal channels.

If you are suspicious that someone wants to scam you or engage in fraudulent activity, you are advised as a customer to contact the bank immediately so that protective measures can be taken promptly. If you receive suspicious communication claiming that it is from Family Bank, you should contact the bank through these numbers: +254 (0) 703 095 445 or +254 (0) 703 095 000 or alternatively, visit the nearest branch for help.

Safe baking during this busy festive season starts by slowing down and taking time to review transactions, using baking tools responsibly and questioning unexpected messages. These tips will help you as a customer to protect your money while enjoying the festivities.

Being aware and sticking to these simple habits will make your spending, travelling and sharing during this holiday not only remain convenient but also secure.

Follow us on Twitter and Facebook for real-time updates.